However, all things are negotiable here just as for a “regular” transaction. Plus, make allowances for the higher costs with a lower offer price. Keep in mind that a short sale involves a contract between the owner and the buyer.

Banks will offer a number of solutions for borrowers who want to avoid foreclosure. Short sale requires a unique set of skills for a real estate agent and the short sale approval can very much depend on how your agent negotiates with the lender and buyer. A short sale is a real estate transaction where a homeowner is facing hardship and gets permission from a bank to sell their property for less than they owe on the mortgage. If your house in Phoenix, AZ is worth less than what you owe on the home loan, a short sale maybe your best alternative to foreclosure.

Fountain Hills Homes

Find all the Arizona foreclosure properties by selecting the links below. Search our entire MLS database of Arizona foreclosures free as long as you like with no obligation. Keep checking back with us since the system is updated twice daily. Find out the pros and cons of purchasing a short sale. The HOA's will usually negotiate the debt, if the homeowner can just call and stay in contact.

Short Sale is when a lender agrees to accept less than the amount owed on the home mortgage. A Short Sale is a real estate transaction in which the sales price is insufficient to pay the loan encumbering the property in addition to the costs of sale and the seller is unable to pay the difference. A short sale involves numerous issues as well as legal and financial risks. This Advisory published by the Arizona Association of Realtors is designed to address some of these issues and risks.

Search Tools

For most properties, however, the price is “wrong”, and, upon foreclosure, the lender becomes the owner of the property in satisfaction of the debt. Regardless of what the home sells for, with a short sale the homeowner doesn't receive any money. “When Short Selling your home, please keep paying your HOA dues and fees. The HOA's seemingly have more power than even the banks in Arizona. Plus, they add such huge fees when delinquent that the bill becomes astronomical by the time of Closing and it has caused many issues in trying to get these deals done." Home Owner Associations are still owed their money, even if you short sale your home or "give it back to the bank" by letting it get foreclosed on.

Rarely will either the seller or lender repair or replace anything. The “As-Is” nature of the sale is in the purchase documents in multiple places. You can and should inspect, but largely for a buy or no-buy decision.

Free Arizona MLS Search

They should disclose the history of the property since they have owned it. The City of Tucson, Arizona has over 700 short sales properties in real estate currently available. This is a great opportunity to invest in one of the most sought-after areas in the real estate market today. Arizona Bank Foreclosures & Government Foreclosed Houses, REO, Federal Homes, Distressed Properties, and Commercial Foreclosures are all at MyOwnArizona.com.

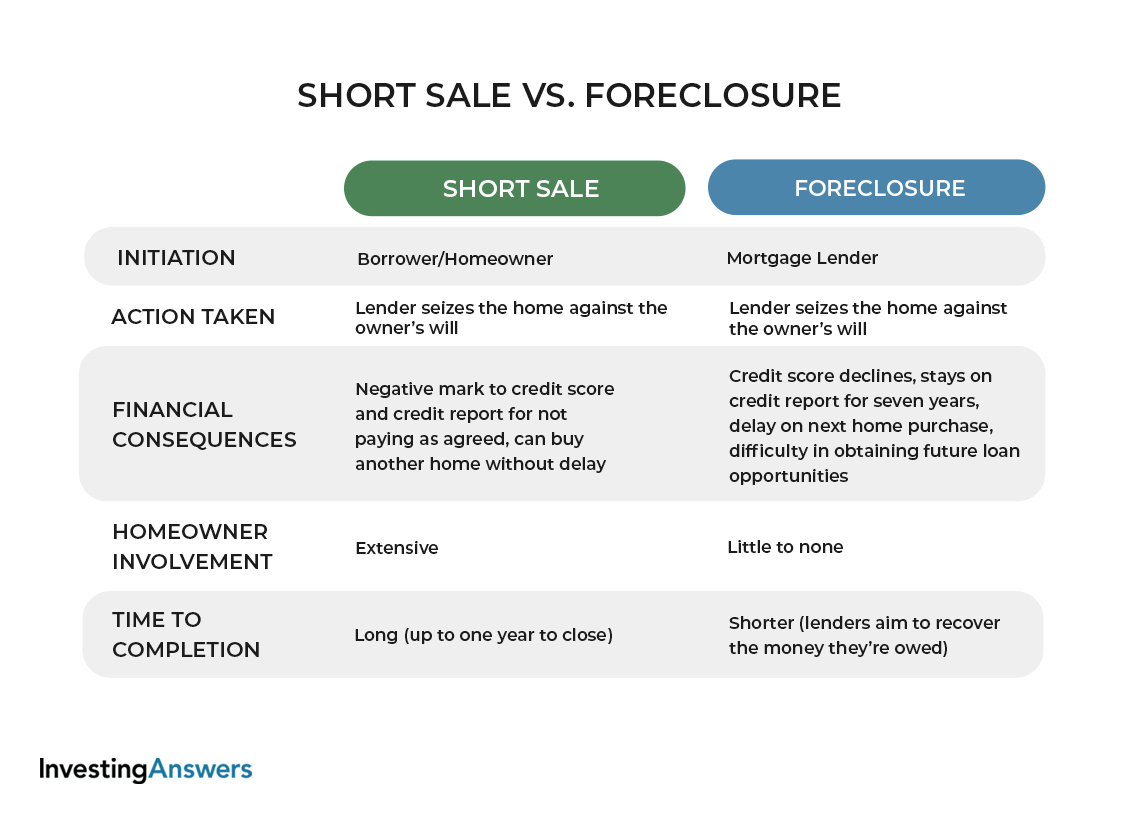

In either case, if you are going to purchase this type of home you will need to know some of the following information to make your home purchase of a Phoenix short sale home much smoother. “Foreclosure” in Arizona occurs nearly always as a result of a trustee sale, which is a form of public auction. When a borrower has not made loan payments for at least 90 days, the lender will file a “Notice of Trustee Sale” – NOTSwith the County Recorder to start the foreclosure process. The NOTS will include the date on which the sale is to occur, which will be at least 90 days after the date of the NOTS, as well as the time and place. “Pre-foreclosure” most accurately refers to the interval between the NOTS and trustee sale date, but it’s sometimes also applied to the delinquency period prior to the NOTS. There's a number of pros and cons to consider when buying short sale.

Short Sales – A Buyer Agent’s Nightmare

In addition, if two lenders are involved because there are two loans secured by the property, dealing with the second lender will extend time periods even longer. It is vital that a very complete short sale package be submitted initially, so that when the first lender finally responds, it’s with the terms and conditions required to allow the short sale to go forward. It is also vital that the listing agent continue to call the first lender to monitor, and promote, progress of the package through the system. Above all else, buying a short sale home requires help from a real estate agent who understands all aspects of the process including how a short sale works for the seller and the homebuyer. On the flipside, short sales can take weeks or even months to complete, which means you're left in limbo waiting for the lender to process your offer. The price may not be worth the hassle, especially if the homeowner has been unable to take care of the property and major repairs are needed.

Short sale Tucson just occurs when there is an absolute assurance that the cash worth of the house can not increase in the future. In order to avoid the risk of a total loss, the bank typically approves the decreased amount of short sale. Short Sales are considered preferable to foreclosures because short sale lessen the impact a foreclosure can have on the surrounding community and won't damage the distressed your credit as much as a foreclosure. For instance, if you are still current with other payments, a short sale may lower your credit score by as little as 50 points. Banks are backed up in the short sale negotiation area. This allows the homeowner to continue living in the home while an offer from a buyer is obtained and the lender is assigning the case internally to their Loss Mitigator.

But this amount is typically more than the market value of the property. The lender may set a lower minimum acceptable settlement amount in hopes of disposing of the property prior to foreclosure auction. If the minimum bid is “right”, this is the best opportunity to acquire a distressed property … just before it becomes an actual REO. The seller’s lender might actually accept the “sacrificial lamb” offer in that case. But getting buyers to submit an offer that is sometimes tens of thousands of dollars above the asking price can be like pulling teeth.

If anyone believes once the market normalizes that short sales will disappear, they are seriously delusional. In fact, they will be around for a very, very, very long time indeed. It discusses options other than short sales including but not limited to Loan Modifications, Deed-In-Lieu of Foreclosures, Foreclosures, Bankruptcy…………. You will always disclose that you have had a foreclosure on any mortgage application as well as many job applications.

They only sustain smaller hit on their credit report for any missed payments and the short sale in Tucson, AZ. Bank looks to prevent a foreclosure, expecting the home to get a higher price with the owner taking care of the property. Many foreclosure properties are abused by angry owners.

A Short Sale may secure Financial Relief they need and Emotional Relief. For the buyers, they can buy homes lower than the market value. During pre-foreclosure, the lender will establish a minimum acceptable amount/bid for which the lender would release their lien on the property. The minimum bid could include the loan balance, past interest payments, and legal fees and costs incurred to start the foreclosure process.

No comments:

Post a Comment